Salesforce-QuickBooks integration is a seamless integration of Salesforce with QuickBooks that enables businesses to integrate both applications and facilitate smoother operations, enhanced data accuracy, and better productivity.

This blog explores what Salesforce and QuickBooks are, why their integration matters, prerequisites, methods for integration, and a step-by-step guide to help you get started.

Salesforce is a branded cloud-based Customer Relationship Management (CRM) program for all real estate and types of industry experts to manage their potential customers, sales, contracts, and save to become a great customer servant.

Salesforce empowers businesses to build strong customer relationships, improve collaboration, and enhance decision-making through data-driven strategies.

It is a popular accounting software used by businesses to manage financial transactions, including invoices, payroll, and expense tracking. Key features of QuickBooks include:

QuickBooks helps businesses of all sizes maintain financial accuracy, compliance, and transparency.

The integration of Salesforce and QuickBooks for businesses comes with lots of benefits.

This integration basically connects the sales and accounting teams, promoting collaboration and guaranteeing smooth operation of the business functions.

Ensure you meet the following prerequisites before integration.

Proper planning and preparation are a must for a successful and seamless integration process.

If you have custom requirements for your business, developers can provide you with an integration using Salesforce and QuickBooks APIs. This approach provides flexibility, but it also demands technical expertise.

Some versions have built-in tools for integration with Salesforce. These tools are simple to use and configure very little.

Zapier, Breadwinner, Crew, Workato, etc., offer simple plug-and-play integrations. These are perfect for businesses seeking customization options.

Middleware is the intermediary that helps in the seamless integration of Salesforce and QuickBooks with ease. MuleSoft and Dell Boomi are a few examples.

Each one has its upside and downside, so pick one that suits your technical ability and business objectives.

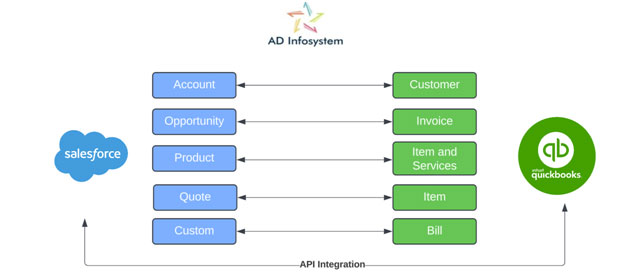

AD infosystem is providing a customize solutions using Salesforce native language and features without using expensive third-party tool where customer need to pay recurring amounts every month or year.

ADIS solutions to synchronize Salesforce’s Accounts, Contacts, Products, and Opportunities with QuickBooks Customers, Jobs, Products, Invoices, Estimates, or Sales Orders using native API integration.

Step-by-Step Process for Salesforce-QuickBooks Integration Follow this guide to connect Salesforce to QuickBooks.

Select a tool or application that best suits your needs, such as business needs, compatibility, budget, and other relevant criteria. The most well-known ones are Zapier, QuickBooks Connector by Intuit, and Breadwinner.

Install our Salesforce manage package. Allowing the app to access your data.

Determine which fields need to sync (i.e., customer information, invoices, payments, etc.). Map these fields correctly so data flows smoothly between Salesforce and QuickBooks.

Run a test to see if it is indeed syncing the data correctly across them. This is the phase where you can find errors or mismatched data.

Set automation rules to perform such actions, like generating an invoice in QuickBooks if a deal closes in Salesforce.

Make routine checks on the integration to confirm it's operating properly. Ensure that any platform updates are also reflected in the integration tool. After following these steps, you can ensure smooth and efficient integration.

Advantages of Salesforce-QuickBooks Integration to Small and Large Businesses Integration isn't about ease; it's about driving tangible business outcomes. Its chief benefits include

It integrates with Salesforce by QuickBooks. The integration will allow you to use a suite of native tools and third-party applications that can work alongside a custom API to automatically facilitate various operations and swiftly realize your business objectives. End.

Use the power of integration to be your best business, and get that Salesforce-QuickBooks integration done NOW!